Due to the erratic and sweeping tariffs imposed by U.S. President Donald Trump, not only has global economic order been disrupted, sparking fears of a U.S. recession and accelerating inflation, but licensed cannabis operators and their affiliated companies are also facing crises such as rising business costs, customer attrition, and supplier backlash.

After Trump’s “Emancipation Day” decree upended decades of U.S. foreign trade policy, over a dozen cannabis industry executives and economic experts warned that the anticipated price hikes would affect every segment of the cannabis supply chain—from construction and cultivation equipment to product components, packaging, and raw materials.

Many cannabis businesses are already feeling the impact of the tariffs, particularly those targeted by retaliatory measures from international suppliers. However, this has also prompted these companies to seek more domestic suppliers wherever possible. Meanwhile, some cannabis retailers and brands are planning to pass on part of the increased costs to consumers. They argue that in an industry already burdened by strict regulation and heavy taxation—while competing with a thriving illicit market—the tariff hikes could exacerbate these challenges.

Trump’s so-called “reciprocal” tariff order briefly took effect on Wednesday morning, specifically targeting manufacturing hubs in Southeast Asia and the European Union with higher tariffs, which are paid by U.S. businesses importing goods from these countries. By Wednesday afternoon, Trump reversed course, announcing a 90-day suspension of the tariff increases for all countries except China.

Cannabis Operators “In the Crosshairs”

Under President Trump’s reciprocal tariff plan, several countries in Southeast Asia and the EU—which supply cannabis businesses and their affiliates with equipment such as point-of-sale systems and raw materials—would face double-digit tariff increases. As trade tensions escalate with China, the U.S.’s largest import partner and third-largest export destination, Beijing missed Trump’s Tuesday deadline to rescind its 34% retaliatory tariffs. As a result, China will now face tariffs as high as 125%.

According to *The Wall Street Journal*, a bill imposing a 10% tariff on all imports from roughly 90 countries took effect on April 5, triggering a record two-day sell-off that wiped out $6.6 trillion in U.S. stock market value. As reported by the Associated Press, Trump’s Wednesday reversal spurred a sharp rebound in U.S. stock indices, pushing them to new all-time highs.

Meanwhile, the AdvisorShares Pure US Cannabis ETF, which tracks U.S. cannabis companies, remained near its 52-week low, closing at $2.14 on Wednesday.

Arnaud Dumas de Rauly, founder of cannabis consultancy MayThe5th and chairman of industry trade group VapeSafer, stated: “Tariffs are no longer just a footnote in geopolitics. For the industry, they pose a direct threat to profitability and scalability. The cannabis sector is facing perilous global supply chain risks, many of which have become significantly more expensive overnight.”

Rising Material Costs

Industry observers say Trump’s policies have already impacted construction material costs, procurement strategies, and project risks. Todd Friedman, Director of Strategic Partnerships at Dag Facilities, a Florida-based commercial construction firm that designs and builds cultivation operations for cannabis companies, noted that the costs of key inputs—such as aluminum, electrical equipment, and security gear—have risen by 10% to 40%.

Friedman added that material costs for steel framing and conduits have nearly doubled in some regions, while lighting and monitoring equipment typically sourced from China and Germany have seen double-digit increases.

The cannabis industry leader also noted shifts in procurement terms. Price quotes that were previously valid for 30 to 60 days are now often reduced to just a few days. Additionally, upfront deposits or full prepayments are now required to lock in pricing, further straining cash flow. In response, contractors are building larger contingencies into bids and contract terms to account for sudden price surges.

Friedman warned: “Clients may face unexpected demands for early payments or need to revise financing strategies mid-construction. Ultimately, the way building projects are planned and executed will be reshaped by tariffs.”

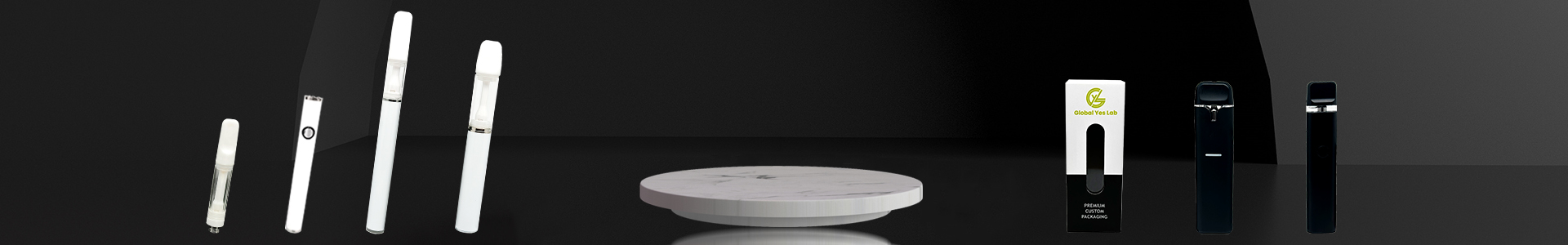

China Tariffs Hit Vape Hardware

According to industry reports, most U.S. vape manufacturers, such as Pax, face unique challenges. Although many have shifted production facilities to other countries in recent years, the vast majority of components—including rechargeable lithium-ion batteries—are still sourced from China.

Following Trump’s latest retaliatory measures, the San Francisco-based company’s cartridges, batteries, and all-in-one devices manufactured in China will face cumulative tariffs as high as 150%. This is because the Biden administration retained the 25% tariff on Chinese-made vaping products originally imposed during Trump’s first term in 2018.

The company’s Pax Plus and Pax Mini products are manufactured in Malaysia, but Malaysia will also face a 24% retaliatory tariff. Economic uncertainty has become a disaster for business forecasting and expansion, yet it now seems to be the new normal.

A Pax spokesperson, Friedman, said: “The cannabis and vaping supply chains are incredibly complex, and companies are scrambling to assess the long-term impact of these new costs and how best to absorb them. Malaysia, once seen as the most viable alternative to Chinese manufacturing, may no longer be an option, and sourcing components has become an even more critical task.”

Tariffs’ Impact on Genetics

U.S. cultivators and licensed growers sourcing premium cannabis genetics from overseas may also face price increases.

Eugene Bukhrev, Marketing Director at Fast Buds, which bills itself as one of the world’s largest autoflowering seed banks, said: “Tariffs on international imports—particularly seeds from major producers like the Netherlands and Spain—could raise the price of European seeds in the U.S. market by about 10% to 20%.”

The Czech Republic-based company, which sells seeds directly to buyers in over 50 countries, expects a moderate operational impact from the tariffs. Bukhrev added: “Our core business’s overall cost structure remains stable, and we are committed to absorbing as much of the additional costs as possible while striving to maintain current prices for customers as long as we can.”

Missouri-based cannabis producer and brand Illicit Gardens has adopted a similar approach with its customers. The company’s Chief Marketing Officer, David Craig, said: “The new tariffs are expected to indirectly raise costs for everything from lighting equipment to packaging. In an industry already operating on thin margins under heavy regulation, even small increases in supply chain expenses can add up to a significant burden.”

Post time: Apr-14-2025