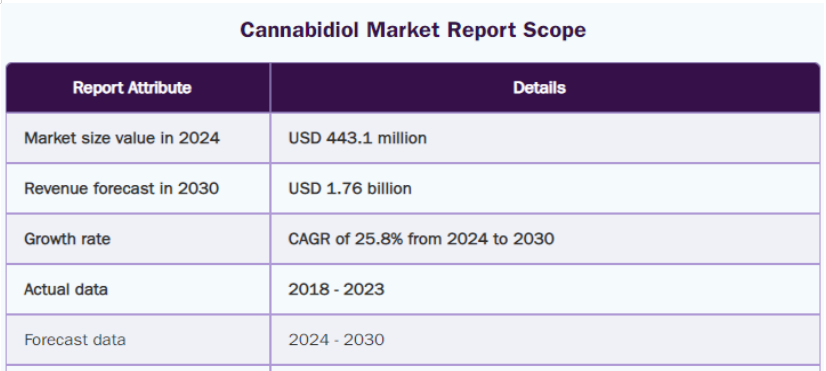

Industry agency data shows that the market size of cannabinol CBD in Europe is expected to reach $347.7 million in 2023 and $443.1 million in 2024. The compound annual growth rate (CAGR) is projected to be 25.8% from 2024 to 2030, and the market size of CBD in Europe is expected to reach $1.76 billion by 2030.

With the increasing popularity and legalization of CBD products, the European CBD market is expected to continue expanding. To meet the needs of consumers, various CBD enterprises are launching various products infused with CBD, such as food, beverages, cosmetics, topical medicines, and electronic cigarettes. The emergence of e-commerce enables these enterprises to leverage a larger customer base and increase product sales through online platforms, which has a positive impact on the growth forecast of the CBD industry.

The characteristic of the European CBD market is the EU’s favorable regulatory support for CBD. Most European countries have legalized the cultivation of cannabis, providing opportunities for start-up companies operating cannabis products to expand their market. Some startups that have contributed to the growth of cannabis CBD products in the region include Harmony, Hanfgarten, Cannamendial Pharma GmbH, and Hempfy. The continuous improvement of consumers’ awareness of health benefits, easy accessibility, and affordable prices have promoted the increasing popularity of CBD oil in the region. Various forms of CBD products are available in the European market, including capsules, food, cannabis oil, cosmetics, and electronic cigarette liquids. Consumers’ awareness of the potential health benefits of CBD is deepening, forcing companies to increase investment in product research and development to better understand its effects and create new products. With more and more companies offering similar products, the competition in the CBD market is becoming increasingly fierce, thereby expanding the market capacity.

In addition, despite the high price, the therapeutic effects of CBD have attracted a large number of consumers to purchase these products. For example, clothing retailer Abercrombie&Fitch plans to sell CBD infused body care products in over 160 of its 250+stores. Many health and wellness stores, such as Walgreens Boots Alliance, CVS Health, and Rite Aid, now stock CBD products. CBD is a non psychoactive compound found in cannabis plants, widely acclaimed for its various therapeutic benefits, such as relieving anxiety and pain. Due to the increasing acceptance and legalization of cannabis and hemp derived products, there has been a surge in demand for CBD products.

Market concentration and characteristics

Industry statistics show that the European CBD market is in a high growth stage, with an increasing growth rate and significant innovation level, thanks to the support of research and development projects focused on the medicinal use of cannabis. Due to the health benefits and almost no side effects of CBD products, the demand for CBD products is on the rise, and people are increasingly inclined to use CBD extracts such as oils and tinctures. The European CBD market is also marked by a moderate number of mergers and acquisitions (M&A) events among top participants. These merger and acquisition activities enable companies to expand their product portfolio, enter emerging markets, and consolidate their position. Due to the establishment of structured regulatory systems for cannabis cultivation and sales in more and more countries, the CBD industry has gained opportunities for vigorous development. For example, according to Germany’s cannabis law, the THC content of CBD products must not exceed 0.2% and must be sold in processed form to reduce abuse. The CBD products offered in the region include dietary supplements such as CBD oil; Other product forms include ointments or cosmetics that absorb CBD through the skin. However, high concentration CBD oil can only be purchased with a prescription. The main participants in the CBD drug market are strengthening their product portfolio to provide customers with diverse and technologically advanced innovative products. For example, in 2023, CV Sciences, Inc. launched its+PlusCBD series of reserve gummies, which contain a full spectrum cannabinoid blend that can provide relief when patients need strong pharmacological effects. The legalization of cannabis derived products has paved the way for many industries to expand their product range. Products containing CBD have evolved from traditional dried flowers and oils to a wide range of categories, including food, beverages, skincare and health products, CBD infused gummies, topical medicines and CBD containing fragrances, and even CBD products for pets. Diversified products attract a wider audience and provide more market opportunities for businesses. For example, in 2022, Canopy Growth Corporation announced that they are expanding their cannabis beverage product line and launching a brand campaign to raise awareness of their wide selection of cannabis beverages.

In 2023, Hanma will dominate the market and contribute 56.1% of the revenue. Due to the increasing awareness of the health benefits of CBD among consumers and the growing demand, it is expected that this niche market will grow the fastest. The continuous legalization of medical marijuana, coupled with the increase in consumer disposable income, is expected to further expand the demand for CBD raw materials in the pharmaceutical industry. In addition, CBD derived from hemp has rapidly gained popularity due to its anti-inflammatory, anti-aging, and antioxidant properties. Various industries, including pharmaceuticals, personal care products, nutritional supplements, and food and beverage companies, are developing products containing CBD for health and wellness purposes. It is expected that this field will continue to experience significant growth in the future. In the B2B end use market, CBD drugs accounted for the largest share of revenue in 2023, reaching 74.9%. It is expected that this category will continue to grow significantly during the forecast period. Currently, an increasing number of clinical trials evaluating the impact of CBD on various health issues will drive demand for these raw material products. Meanwhile, injectable CBD products are often used by patients as alternative drugs to relieve pain and stress, which will also contribute to market growth. In addition, the increasing popularity of the medical advantages of CBD, including its therapeutic properties, has transformed CBD from a herbal ingredient to a prescription drug, which is also an important factor driving market growth. The B2B segmented market dominates the market sales, contributing the largest share of 56.2% in 2023. Due to the increasing number of wholesalers providing CBD oil and the growing demand for CBD oil as a raw material, it is expected that this niche market will achieve the fastest compound annual growth rate during the forecast period. The continuous growth of customer base and the promotion of legalization of CBD products in various European countries have paved the way for more distribution opportunities. Institutions predict that the hospital pharmacy segment market in B2C will also experience significant growth in the future. This growth can be attributed to the increased cooperation between businesses and retail pharmacies, aimed at enhancing their visibility and creating dedicated CBD product areas for customers. In addition, as the number of pharmacies storing CBD products increases, exclusive alliances are established between businesses and retail pharmacies, and more and more patients choose CBD as a treatment alternative, which will provide ample opportunities for market participants. Due to the establishment of hemp production facilities in the European Union (EU), it is expected that the European CBD market will achieve a compound annual growth rate of 25.8% during the forecast period, achieving substantial growth. Hanma seeds can only be purchased from EU certified suppliers to ensure the correct variety, as Hanma is a rich source of CBD.

In addition, indoor cultivation of hemp is not advocated in Europe, and it is generally grown in outdoor farmland. Many companies are engaged in the extraction of bulk CBD fractions and increasing production capacity to meet the growing demand. The best-selling product in the UK CBD market is oil. Due to its therapeutic benefits, affordable price, and easy accessibility, CBD oil continues to soar in popularity. Project Twenty21 in the UK plans to provide medical marijuana to patients at a capped price, while collecting data to provide proof of funding for the NHS. CBD oil is widely sold in retail stores, pharmacies, and online stores in the UK, with Holland and Barrett being the main retailers. CBD is sold in various forms in the UK, including capsules, food, cannabis oil, and electronic cigarette liquids. It can also be sold as a food supplement and used for personal care products. Many food producers and restaurants, including Minor Figures, The Canna Kitchen, and Chloe, inject CBD oil into their products or food. In the cosmetics field, Eos Scientific has also launched a series of CBD infused cosmetics under the Ambiance Cosmetics brand. Famous players in the UK CBD market include Canavape Ltd. and Dutch Hemp. In 2017, Germany legalized medical marijuana, allowing patients to obtain it through prescription. Germany has allowed about 20000 pharmacies to sell medical marijuana with prescriptions.

Germany is one of the earliest countries in Europe to legalize medical marijuana and has a huge potential market for non-medical CBD. According to German regulations, industrial hemp can be grown under strict conditions. CBD can be extracted from domestically grown hemp or imported internationally, provided that the THC content does not exceed 0.2%. CBD derived edible products and oils are regulated by the German Federal Institute for Drugs and Medical Devices. In August 2023, the German Cabinet passed a bill legalizing the use and cultivation of recreational marijuana. This move makes the CBD market in Germany one of the freest markets in European cannabis law.

The French CBD market is growing rapidly, with a significant trend being the diversification of product supply. In addition to traditional CBD oils and tinctures, the demand for cosmetics, food, and beverages containing CBD has also surged. This trend reflects a broader shift towards integrating CBD into daily life, rather than just health supplements. In addition, people are increasingly valuing product transparency and third-party testing to ensure quality and regulatory compliance.

The regulatory environment for CBD products in France is unique, with strict regulations on cultivation and sales, so product supply and marketing strategies must be consistent with it. The Netherlands has a long history of using marijuana, and in 2023, the CBD market in the Netherlands dominated this field with the highest share of 23.9%.

The Netherlands has a strong research community for cannabis and its components, which may contribute to its CBD industry. Compared to other European countries, the Netherlands provides a more favorable environment for businesses involved in CBD.The Netherlands has a long history in cannabis products, therefore it has early expertise and infrastructure related to CBD production and distribution. The CBD market in Italy is expected to become the fastest-growing country in this field.

In Italy, 5%, 10%, and 50% CBD oils are approved for sale in the market, while those classified as food fragrances can be purchased without a prescription. Hanma oil or Hanma food is considered a seasoning made from Hanma seeds. Purchasing fully extracted cannabis oil (FECO) requires an appropriate prescription. Cannabis and Han Fried Dough Twists, also known as hemp lamps, are sold on a large scale in the country. The names of these flowers include Cannabis, White Pablo, Marley CBD, Chill Haus, and K8, sold in jar packaging by many Italian cannabis shops and online retailers. The jar strictly states that the product is for technical use only and cannot be consumed by humans. In the long run, this will drive the development of the Italian CBD market. Many market participants in the European CBD market are focusing on various initiatives such as distribution partnerships and product innovation to maintain their position in the market. For example, in October 2022, Charlotte’s Web Holdings, Inc. announced a distribution partnership with GoPuff Retail Company. This strategy has enabled Charlotte Company to enhance its capabilities, expand its product portfolio, and strengthen its competitiveness. The main participants in the CBD drug market expand their business scope and customer base by providing customers with diversified, technologically advanced, and innovative products as a strategy.

Major CBD players in Europe

The following are the major players in the European CBD market, which hold the largest market share and determine industry trends.

Jazz Pharmaceuticals

Canopy Growth Corporation

Tilray

Aurora Cannabis

Maricann,Inc.

Organigram Holding,Inc.

Isodiol International,Inc.

Medical Marijuana,Inc.

Elixinol

NuLeaf Naturals,LLC

Cannoid,LLC

CV Sceiences,Inc.

CHARLOTTE’S WEB.

In January 2024, Canadian company PharmaCielo Ltd announced a strategic partnership with Benuvia to produce cGMP pharmaceutical grade CBD isolates and related products, and introduce them to global markets including Europe, Brazil, Australia, and the United States.

Post time: Feb-25-2025