Currently, hemp-derived THC products are sweeping across the United States. In the second quarter of 2024, 5.6% of surveyed American adults reported using Delta-8 THC products, not to mention the variety of other psychoactive compounds available for purchase. However, consumers often struggle to clearly understand the differences between hemp-derived THC products and other cannabinoid products. Open-ended responses in our CBD survey frequently mention psychoactive cannabinoids and hemp-derived THC brands. Many consumers also report purchasing these products from dispensaries, confusing them with hemp products sold in tobacco shops and regulated cannabis products. To address this widespread confusion, Brightfield Group conducted a survey in the first half of 2024, focusing on the history, usage, and preferences of hemp-derived THC users. The survey clearly defined the differences between CBD, cannabis, and hemp-derived THC products to enhance data reliability.

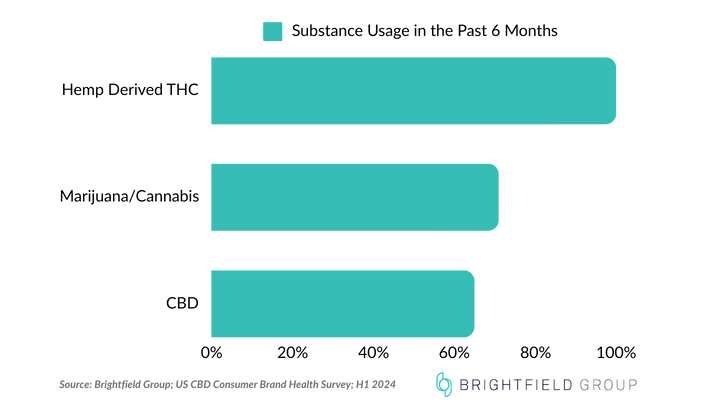

Overlap in Cannabinoid Use

The overlap within the cannabinoid industry is significant. In the first half of 2024, 71% of hemp-derived THC consumers reported using cannabis, while 65% had purchased CBD in the past six months. Despite using various cannabinoid products, many consumers still lack understanding of what they are using. For example, only about 56% of respondents were aware that Delta-9 THC is the primary psychoactive compound in cannabis.

Consumer Motivations and Market Dynamics

So, what is driving consumers into the market? The survey found that the primary reason for purchasing hemp-derived THC is its availability, with 36% of respondents selecting this option. The legality of cannabis is also a key factor, as many consumers use hemp products in states without regulated markets. Other common reasons for using hemp-derived THC products include preferences for flavor/scent, social acceptability, and the milder effects offered by some hemp products. The survey data clearly indicates that hemp-derived THC is becoming a strong competitor in the existing cannabis market. 18% of respondents reported switching from cannabis to hemp-derived THC, and nearly 22% were new to cannabinoids through hemp-derived THC. This suggests that for some, these products serve as an entry point into the world of cannabinoids.

Profile of Hemp-Derived THC Consumers

What does a typical hemp-derived THC consumer look like? Demographically, hemp-derived THC consumers are slightly more likely to be male, younger, with lower income and education levels; CBD users are fewer, especially those purchasing high-dose products. Low-dose THC gummy consumers tend to have higher education and income levels but still skew young and male. Most hemp-derived THC consumers prefer in-person purchases. While only one-fifth shop on brand websites, over half purchase from tobacco/vape/cannabis shops, and nearly 40% buy from specialized hemp retailers. THC gummies are one of the most popular product forms, with over 60% of respondents reporting regular use. Inhaled products like flower, pre-rolls, and vapes also perform well. The study found that about 30% of respondents prefer multiple low-dose gummies, while THC beverages rise to 42%, indicating a niche market for “microdosers” not just seeking high THC concentrations. Additionally, 58% of consumers report consuming THC gummies with 5 mg or less per dose, while only 20% prefer doses over 10 mg.

avigating the Evolving Hemp-Derived THC Market

Understanding these consumer trends and preferences is invaluable for businesses in the hemp-derived THC space. Insights into consumer demographics, purchasing habits, and product preferences, along with many other potential data points, can help chart a roadmap for growth and innovation, ensuring businesses can effectively navigate and sustain in the ever-changing landscape of the hemp-derived THC industry. The rise of hemp-derived THC products brings both opportunities and challenges. As the market continues to evolve, understanding consumer trends and preferences is crucial for businesses seeking success. By leveraging survey and social listening data, businesses can better understand and meet customer needs, driving innovation and growth in this vibrant industry.

Post time: Mar-10-2025